The Professional Investor's Guide to Crystal Collecting and Valuation

Introduction: Navigating the Modern Crystal Investment Landscape

Crystal collecting has matured from a hobby with a low barrier to entry into a serious investment class, demanding a sophisticated understanding to navigate successfully. The market, once accessible to all, has grown increasingly complex. While natural crystals are prized for their unique beauty and the rich significance endowed upon them, the landscape is now fraught with challenges, including a prevalence of imitations and a lack of standardized valuation criteria. This guide is designed to cut through that opacity.

Fundamentally, a genuine crystal is a naturally occurring mineral composed of silicon dioxide. This geological origin is the source of its intrinsic value, distinguishing it from visually similar but commercially worthless glass products. Many items marketed as "crystal"—from lamps to glassware—are, in fact, merely glass, and a prudent investor must first learn to differentiate the authentic from the artificial.

The purpose of this guide is to provide investors with a systematic framework for identifying true value, authenticating specimens, and making informed acquisition decisions. In a market where fakes are common and grading standards are not universal, equipping yourself with expert knowledge is not just an advantage—it is a necessity for protecting and growing your investment. The cornerstone of any sound investment is a deep understanding of what drives an asset's price, and in the world of crystals, this begins with a mastery of its core valuation principles.

--------------------------------------------------------------------------------

1. The Core Pillars of Crystal Valuation: A Framework for Investors

For the serious investor, moving beyond subjective appreciation to objective analysis is paramount. A standardized valuation framework transforms a simple collection into a strategic portfolio. While the beauty of a crystal is in the eye of the beholder, its market value is determined by a consistent set of measurable factors. Understanding these pillars is what separates the casual enthusiast from the discerning investor who can identify and acquire assets with genuine long-term potential.

Macro-Economic Forces Governing the Market

Before assessing an individual specimen, an investor must understand the three primary forces that shape the entire crystal market. These factors dictate the overarching trends in supply, demand, and perceived worth.

- People's Preference: This is the most powerful driver of a crystal's price. Cultural history, consumer trends, and symbolic associations directly influence demand. A crystal that resonates with a culture's values or becomes a fashionable commodity will command a higher price, irrespective of its other qualities.

- Market Rarity: Value is intrinsically linked to scarcity. The natural abundance of a specific type of crystal on a global scale establishes its baseline rarity. An inverse relationship exists: the less common a crystal is in nature, the higher its potential market value.

- Intrinsic Quality: Ultimately, the physical and aesthetic characteristics of the crystal itself determine its fundamental value. High marks in this category are non-negotiable for an investment-grade piece. While preference and rarity can create price bubbles, it is the intrinsic quality that provides a stable floor for a crystal's worth.

To systematically evaluate a crystal's intrinsic quality, professional appraisers employ a framework based on the globally recognized "4Cs" of gemology, enhanced with a fifth, more nuanced criterion: Aesthetic Value.

1.1. Color

Color is often the first and most critical attribute an investor assesses. Value is directly correlated with the quality of its hue. An investment-grade crystal should display a color that is saturated, vibrant, and uniform. Paler, washed-out tones are significantly less valuable than deep, rich ones. An even distribution of color, free from undesirable zoning or blotchiness, is the ideal.

1.2. Clarity

Clarity refers to the internal purity of the crystal. A specimen with high transparency and a minimal number of internal inclusions, fractures, or "clouds" is considered more valuable. These internal features can obstruct the passage of light, diminishing the crystal's brilliance and overall beauty. While some crystal types are valued for their inclusions (see Phantom Quartz), in most cases, higher clarity corresponds directly to higher value.

1.3. Cut

Craftsmanship is the human element that transforms a raw stone into a finished asset. A masterful cut can dramatically enhance a crystal's value. This includes the precision of the facets, the quality of the polish, and the overall artistry of the form, whether it's a faceted gem, a smooth sphere, or an intricate carving. A well-executed cut maximizes the crystal's color, clarity, and brilliance.

1.4. Carat

Carat is the standard unit of weight for gemstones. As a general rule, the value of a crystal increases with its size. However, this principle only holds true when quality is maintained. A large, low-quality crystal with poor color and clarity will be worth significantly less than a smaller, but flawless, specimen. Size amplifies the value of other high-quality attributes; it cannot compensate for their absence.

1.5. Aesthetic Value

This fifth pillar is what elevates a high-quality crystal to an extraordinary one. Aesthetic value, or ornamental value, encompasses the unique and often unquantifiable visual phenomena that make a piece truly special. This includes:

- Rare Inclusions: Mineral inclusions that form distinct, evocative shapes such as miniature landscapes, pyramids, or layered mountains.

- Optical Effects: Phenomena such as asterism (a star-like effect with six, twelve, or more rays visible under a single light source) or a cat's eye effect, where light forms a bright, silky band across the surface.

- Distinct Patterns: Unique color arrangements or internal structures that create a visually compelling and rare "picture" within the stone.

A crystal that exhibits exceptional aesthetic value can command a price far exceeding that of a similarly sized piece that lacks such a unique character. This is where an investor's discerning eye for artistry and rarity becomes a critical asset.

This comprehensive valuation framework is the essential toolkit for any investor, but its power is predicated on one crucial assumption: that the specimen being evaluated is genuine.

--------------------------------------------------------------------------------

2. Investor Due Diligence: A Guide to Authentication

Authentication is the most critical risk management strategy in the crystal market. The proliferation of fakes, imitations, and undisclosed treatments poses a significant financial threat to the uninformed investor. Mistaking a piece of skillfully crafted glass or a dyed specimen for a natural crystal can result in a total loss of capital. While definitive identification requires laboratory equipment, several non-instrumental methods can serve as a crucial first line of defense.

- Observing Double Refraction: This is a key optical property of natural crystal that is absent in glass. To test for it, place the crystal over a single thin line, such as a strand of hair. Look through the crystal at the line. In a genuine crystal, you will see a distinct doubling of the image—two lines will be visible. Glass, being singly refractive, will only show one line.

- Analyzing Inclusions: Nature is rarely perfect. The presence of natural growth textures, cloud-like inclusions, and internal cleavage planes are often strong indicators of authenticity. Conversely, man-made glass is often either perfectly flawless or contains tell-tale signs of its artificial origin, such as perfectly spherical air bubbles trapped within.

- Hardness Test: Natural crystal has a Mohs hardness of 7, making it significantly harder than glass, which ranks around 5. This means a genuine crystal can scratch a piece of glass, while glass cannot scratch crystal. This test is potentially destructive and should be performed with extreme caution, preferably on an inconspicuous area, as it can damage the specimen.

- Assessing Weight: An experienced collector can often feel the difference in density between crystal and its imitations. Genuine crystal has a noticeable heft and a higher specific gravity, feeling heavier in the hand than a piece of glass of the same size.

While these preliminary tests are invaluable for on-the-spot screening, they are not infallible. For any high-value acquisition, an investor must insist on a certificate from a professional and reputable gemological laboratory. This is the only definitive method of authentication and serves as your ultimate protection against fraud.

With these foundational skills in valuation and authentication, we can now turn our attention to analyzing the investment profiles of specific, high-potential crystal categories.

--------------------------------------------------------------------------------

3. Investment Profiles of Major Crystal Categories

This section provides a detailed analysis of the investment potential of the most significant crystal types in today's market. For each category, we will dissect its market position, outline the specific characteristics that drive its value, and identify the common pitfalls and fakes that every investor must learn to avoid.

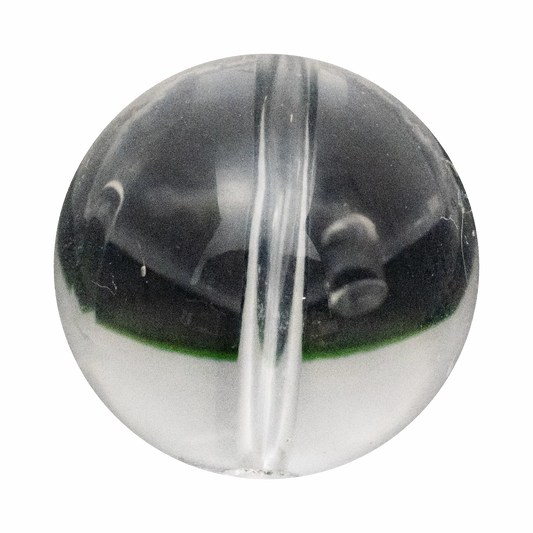

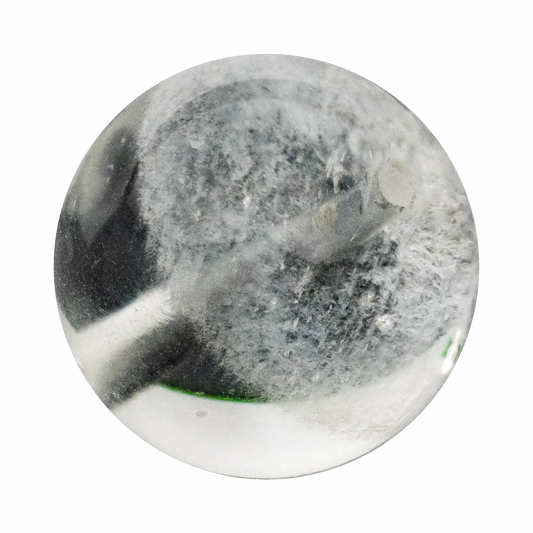

3.1 White Crystal

- Market Position & Popularity: As the most abundant and foundational variety of quartz, White Crystal is an excellent entry point for new collectors. While common grades are very affordable, pieces of exceptional size, clarity, and craftsmanship hold significant investment value and are highly sought after by discerning collectors.

-

Key Investment Value Drivers:

- Exceptional Size: Value escalates dramatically with size, provided quality is maintained. Large, masterfully executed carvings (especially those weighing over 20 kg) and perfectly flawless spheres (exceeding 10 cm in diameter) are considered premier investment pieces.

- Purity & Clarity: For White Crystal, clarity is the single most important determinant of quality. The most valuable specimens are virtually transparent, appearing as if they were carved from pure ice, completely free of internal fractures, clouds, or inclusions.

- Quality of Craftsmanship: In finished pieces like carvings and sculptures, the skill of the artist is a primary value driver. Works by recognized masters command a substantial premium.

-

Common Pitfalls & Fakes:

- Glass Imitations: Due to its clarity, White Crystal is frequently imitated using common glass, particularly for items like bracelets and pendants. These imitations have no secondary market value and are worthless from an investment perspective.

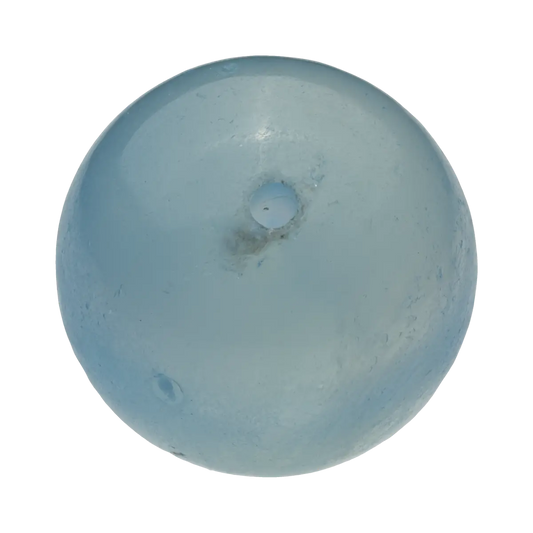

3.2 Rose Quartz

- Market Position & Popularity: Rose Quartz consistently ranks among the top five best-selling crystals, beloved for its delicate pink hues. Its investment value, however, is highly stratified and heavily dependent on its specific type and the quality of its color and optical phenomena.

-

Key Investment Value Drivers:

- Star Effect (Asterism): Star Rose Quartz is the superior investment choice within this category. Its value is derived from a distinct six-rayed star that becomes visible when a single, direct light source is shined upon its surface.

- Origin & Color: The most prized variety is Madagascar Rose Quartz, which is celebrated for its rich, vibrant, and deep pink coloration that far surpasses the paler shades of more common varieties.

- Transparency: While most Rose Quartz is translucent, specimens that combine exceptional, gem-like clarity with the deep color of Madagascar material are rare and command the highest prices.

-

Common Pitfalls & Fakes:

- Dyed Products: A very common practice involves dyeing low-grade, pale quartz to mimic the appearance of high-quality Rose Quartz. Investors should be highly suspicious of unnaturally uniform or intense colors and inspect any cracks or fissures for concentrations of dye.

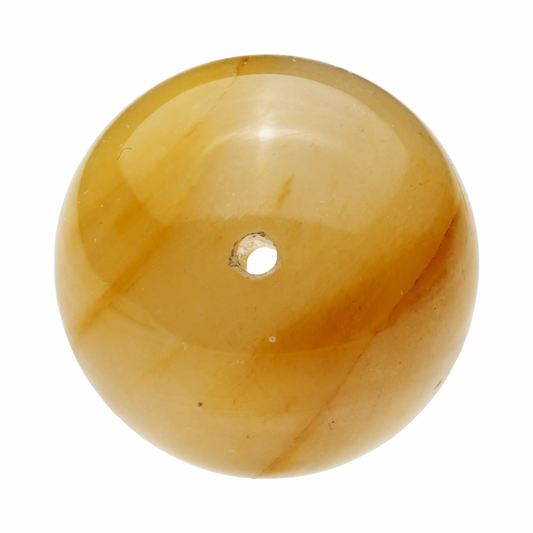

3.3 Citrine

- Market Position & Popularity: Citrine is another top-five seller, with its popularity bolstered by a strong cultural association with wealth and prosperity, earning it the moniker "yellow gemstone." This cultural significance drives powerful and consistent demand.

-

Key Investment Value Drivers:

- Natural Origin: This is the most crucial value determinant. There is an immense price difference between rare, natural Citrine and the far more common heat-treated variety. Natural specimens, such as those from Brazil, often exhibit subtle growth lines or textures that are absent in treated stones.

- Color Richness: The most desirable color is a deep, vibrant, and uniform yellow to orange-yellow. The finest specimens are often referred to by their origin or trade name, such as "Brazil Yellow" or "Donghai Yellow."

- Rare Asterism: Natural Citrine that displays a star effect (either six or twelve-rayed) is exceptionally rare. Such specimens are considered phenomenal collector's items with extraordinary value.

-

Common Pitfalls & Fakes:

- Heat-Treated Amethyst: The vast majority of "Citrine" on the market is actually low-grade Amethyst or Smoky Quartz that has been heated to induce a yellow or orange color. These pieces are significantly less valuable. They can often be identified by an intense, slightly reddish-orange hue and a lack of the subtle color zoning found in natural Citrine.

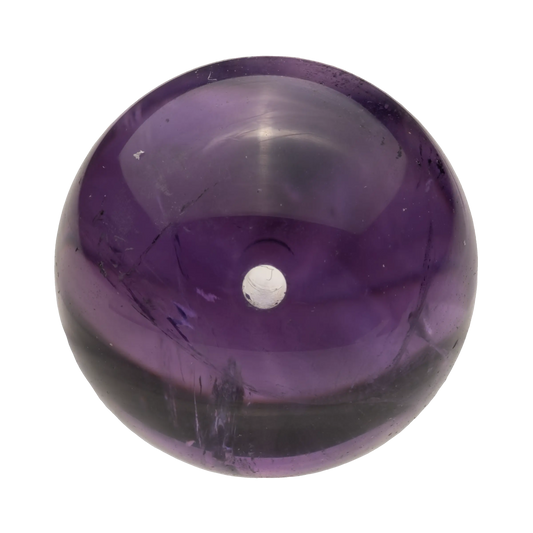

3.4 Amethyst

- Market Position & Popularity: A perennial top-five crystal, Amethyst is famously known as the "guardian stone of love." The market is mature and sophisticated, offering a very wide spectrum of quality, from inexpensive tumbled stones to museum-grade gems and geodes.

-

Key Investment Value Drivers:

- Color Saturation: Color is the most critical factor in valuing Amethyst. The ideal is a deep, rich, and vibrant purple that is evenly distributed throughout the stone. The color should be strong without being so dark that it appears black under normal lighting conditions.

- Clarity: For any Amethyst intended for faceting into a gemstone or for use in high-end beaded jewelry, excellent clarity free of significant inclusions is paramount.

- Geodes & Carvings: In its raw form, Amethyst is highly valued as decorative and collector's specimens. Large, well-formed Amethyst geodes with deep purple coloration and pristine, undamaged crystal points are major investment pieces.

-

Common Pitfalls & Fakes:

- Misleading Color Descriptions: The evaluation of purple can be subjective. Investors should be wary of exaggerated claims about color and always insist on a visual inspection in person or with high-quality images under neutral, full-spectrum lighting.

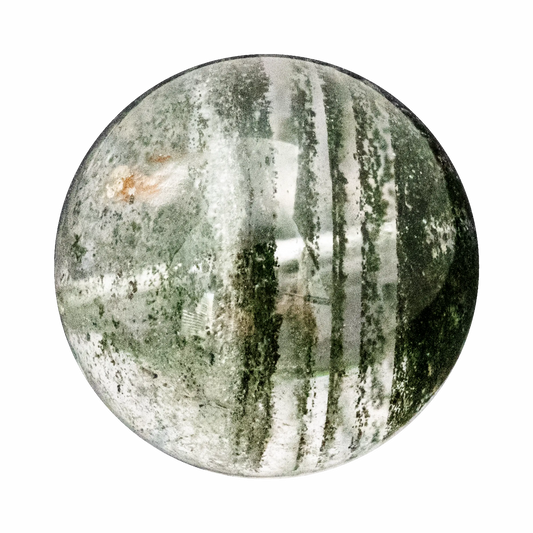

3.5 Phantom Quartz

- Market Position & Popularity: Phantom Quartz is a highly specialized and sought-after category where the value is derived almost entirely from the beauty, clarity, and formation of its internal mineral inclusions. These pieces are collected as miniature natural landscapes trapped within the crystal.

-

Key Investment Value Drivers:

- Inclusion Shape: The most valuable and desirable formations are those that create distinct, recognizable, and aesthetically pleasing shapes. These include Pyramids, multi-layered Mountains, and bowl-shaped Treasure Basins.

- Inclusion Color & Type: Market preference strongly dictates value. Green Phantom is the most classic, popular, and valuable variety. It is followed in desirability by Red, White, Yellow, and multi-colored Phantoms.

- Clarity of Host Crystal: To maximize the beauty and visibility of the internal "landscape," the host quartz crystal must be as transparent and flawless as possible. A cloudy or fractured host crystal severely diminishes the value.

-

Common Pitfalls & Fakes:

- Dyed Inclusions: Be cautious of phantoms with unnaturally vivid colors. Dyes can be introduced to enhance or create the appearance of colored inclusions. Natural coloration should appear integrated with the crystal's growth patterns, not as a foreign substance concentrated in cracks.

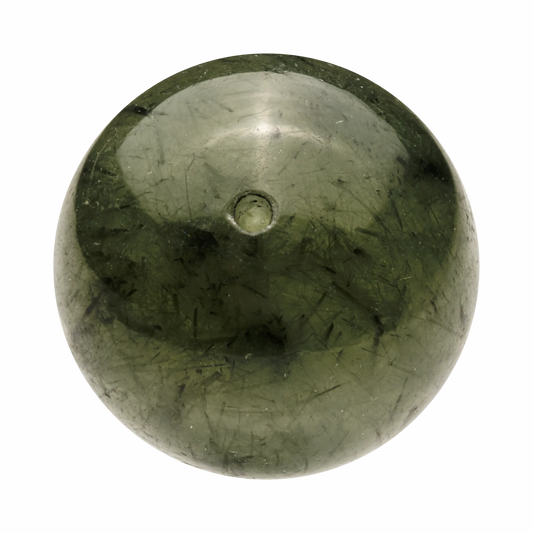

3.6 Rutilated Quartz

- Market Position & Popularity: This is a premier investment category within the quartz family. Its value is determined not by the clarity of the host crystal alone, but by the quality, density, and arrangement of the needle-like rutile inclusions within it.

-

Key Investment Value Drivers:

- Premier Varieties: The undisputed leaders in value are Titanium Rutilated Quartz, which contains thick, plate-like, metallic golden rutile, and Gold Rutilated Quartz, which contains finer golden needles.

- Rutile Quality: Value is assessed based on the "hairs" themselves. The ideal is a high density of thick, straight, and brilliantly lustrous needles. Disorganized, sparse, or dull needles significantly reduce value.

- Optical Effects: The presence of a "cat's eye effect" marks a piece as exceptionally valuable. This occurs when the rutile needles are perfectly and densely aligned, creating a shimmering band of light that moves across the surface as the stone is turned.

- Other Valued Types: While Gold and Titanium are the most prized, other investment-grade varieties include Copper, Black, and Silver Rutilated Quartz.

-

Common Pitfalls & Fakes:

- Color Alteration: Some lower-grade Gold Rutilated Quartz may be artificially color-enhanced to appear more golden and vibrant. Look for an unnatural uniformity of color that is inconsistent with natural mineral growth.

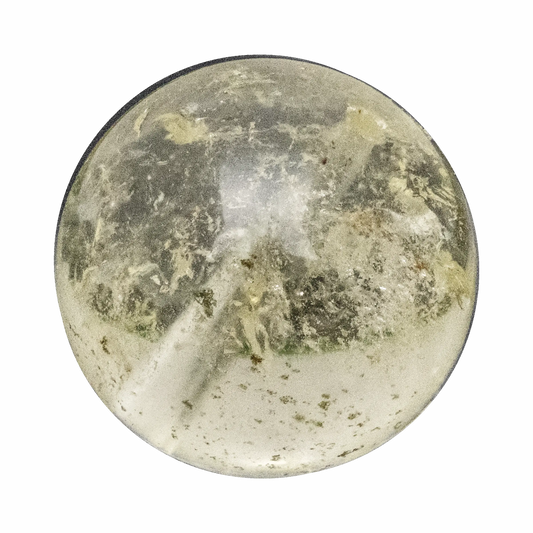

3.7 Super Seven

- Market Position & Popularity: Known in the trade as Auralite 23, this is a modern collector's phenomenon that has seen rapid price appreciation, reportedly rising tenfold in recent years. Its value is derived from its incredibly complex composition, containing a combination of multiple different minerals within a single host crystal.

-

Key Investment Value Drivers:

- Mineral Richness: The core of its value lies in the visible diversity of its mineral inclusions. The more distinct colors, textures, and mineral types that are clearly visible within a single piece, the higher its value.

- Aesthetic Composition: Beyond mere mineral count, pieces are prized for their aesthetic arrangement. Specimens where the included minerals form visually appealing patterns, landscapes, or color combinations are the most sought-after.

-

Common Pitfalls & Fakes:

- Misrepresentation: The "Super Seven" or "Auralite 23" name is often applied liberally to stones that do not contain the full combination of signature minerals. Due to the complexity of identification, securing a piece with certification from a reputable lab or purchasing from a highly trusted expert dealer is crucial to ensure you are acquiring a genuine specimen.

--------------------------------------------------------------------------------

4. Final Strategic Checklist for the Crystal Investor

Successful crystal investing is a sophisticated discipline that requires a synthesis of geological knowledge, keen market awareness, and refined aesthetic judgment. It is a field where diligence is rewarded and impulsiveness is penalized. By internalizing the principles of valuation and authentication, you can build a collection that is not only beautiful but also a formidable alternative asset.

To conclude, here is a final strategic checklist to guide every acquisition:

- Define Your Investment Thesis: Before making a purchase, clearly define your budget and collection goals. Are you targeting entry-level affordability for portfolio diversification, exceptional rarity for long-term capital appreciation, or specific aesthetic qualities for personal enjoyment? A clear goal prevents impulsive buys.

- Prioritize Quality Over Quantity: This is the golden rule of collecting. A single, exceptional, investment-grade crystal will always hold more long-term value and liquidity than a dozen mediocre pieces. Focus your capital on the best example you can afford within your target category.

- Value the Artistry: For any worked or carved piece, remember the principle of "7 parts nature, 3 parts artisanship." The raw material is the foundation, but the skill of the artist who shaped it is a massive value-multiplier. Do not underestimate the premium that masterful craftsmanship commands.

- Demand Definitive Proof: Make professional gemological certification a non-negotiable condition for any significant purchase. A certificate from a reputable laboratory is your best insurance against fakes, undisclosed treatments, and misrepresentation. It provides objective data to support your investment decision.

- Analyze the Complete Picture: Never evaluate a potential acquisition in a vacuum. Always apply the full valuation framework—considering the macro-market forces of preference and rarity alongside the micro-details of the "4Cs + A" (Color, Clarity, Cut, Carat, and Aesthetic Value). A holistic assessment is the hallmark of a professional investor.